Investing can feel like navigating a maze. Markets shift, risks multiply, and one bad call can derail your plans. Many investors struggle to spot threats early or make sense of messy data.

Without the right tools, managing these challenges becomes overwhelming.

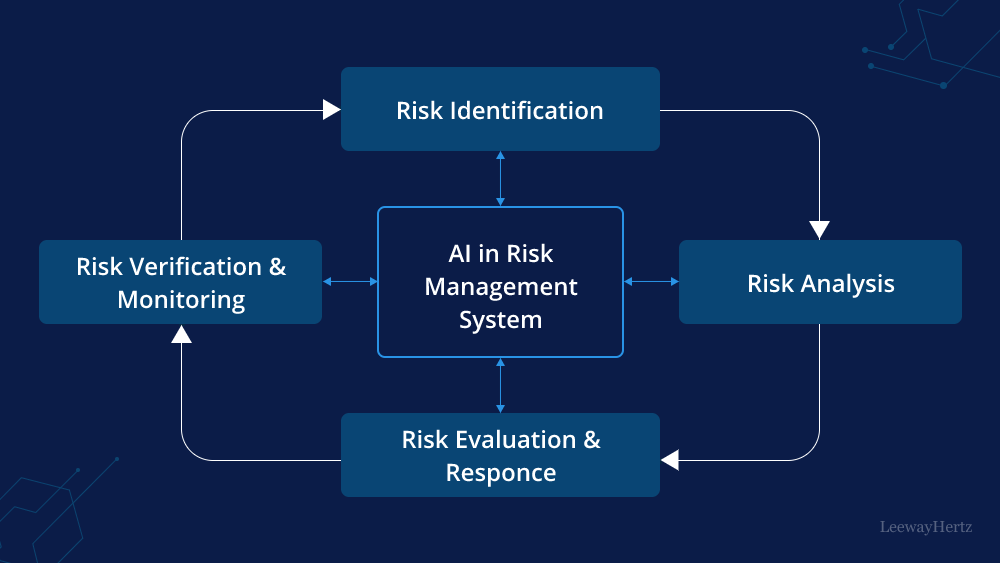

Here’s where AI risk management systems step in. These systems analyze massive amounts of data quickly, identify potential issues, and help reduce investment risks. With their growing role in finance, modern investors are now relying on AI to stay ahead.

In this blog, you’ll explore how these systems work and how they can fit into your strategy. Keep reading to discover smarter ways to manage risks!

Key Features of AI Risk Management Systems

AI risk management systems act like a guide, steering you through uncertain markets. They provide resources that clarify complex data for more informed decisions.

Real-time data analysis

Real-time data analysis provides investors with immediate insights into market trends and risks. It processes vast amounts of financial data instantly, assisting traders in identifying sudden changes in asset prices or market fluctuations.

Tools supported by machine learning continuously monitor global news, stock activity, and economic events. ‘Timing is everything in investing,’ as the old saying goes. Instant updates enable confident decisions before opportunities are lost. For instance, traders tracking fast-moving assets such as the best $1 dollar stocks can use these systems to spot momentum shifts early and act before the market reacts.

Predictive modeling and forecasting

Predictive modeling uses machine learning to analyze past data and predict future trends. Investors can identify patterns in market behavior, helping them make informed decisions about their portfolios.

This process evaluates factors like asset performance, economic indicators, and historical financial trends.

Forecasting builds on these models by estimating potential risks or opportunities based on current conditions. It helps traders anticipate market shifts before they happen. For instance, a predictive model might signal an increase in stock price volatility ahead of time, giving investors room to adjust strategies early.

Reliable forecasting tools act as a guide for navigating uncertain markets with confidence.

Automated early warning systems

Automated early warning systems help detect potential risks in real-time. These tools monitor market volatility, asset performance, and portfolio trends simultaneously. By analyzing large datasets with AI-based insights, they notify investors of concerns before significant losses occur.

Such systems can identify issues like credit risks or sudden price drops with impressive speed. Traders can act quickly to adjust their investment strategies based on these notifications.

This approach reduces reaction time during volatile markets and fits well with predictive modeling techniques for more informed decision-making.

Benefits of AI in Investment Risk Management

AI simplifies how investors handle risks. It spots problems early, saving time and money.

Enhanced decision-making accuracy

AI systems process vast amounts of data in seconds, offering clear insights to investors. These tools analyze market trends, past performance, and current conditions, reducing guesswork.

Investors gain clarity when choosing between assets or strategies.

Predictive modeling identifies potential risks before they appear. Armed with this knowledge, traders can make confident decisions that align with their investment goals. Accurate information leads to smarter choices and fewer costly mistakes.

Proactive risk mitigation

Investors reduce potential losses by identifying risks early and acting quickly. AI tools analyze large datasets to identify market trends or anomalies before they escalate. For example, machine learning models can highlight sudden shifts in asset values or detect unusual trading patterns.

Real-time data analysis provides alerts about volatile sectors, helping traders adjust strategies promptly. Predictive analytics assists investors in preparing for downturns or capturing opportunities before competitors.

This ensures portfolios remain balanced while reducing exposure to high-risk assets.

– Enhanced portfolio management

Improved portfolio optimization

AI systems analyze market data to refine asset allocation. They assess risk profiles and recommend investment strategies customized to individual goals. These tools consider changing market conditions in real time, offering insights that improve decision-making.

Machine learning identifies patterns in historical data. It forecasts trends and helps investors balance risks while increasing returns. Enhanced portfolio management reduces exposure to volatility without sacrificing growth potential.

Popular AI Tools for Risk Management

Explore powerful AI tools reshaping how investors handle risk and stay ahead in volatile markets.

AI-driven stress testing platforms

AI-driven stress testing platforms simulate extreme market conditions to assess portfolio strength. They include predictive modeling and data analytics, providing traders with insights into potential investment risks.

These tools examine responses to market fluctuations, supporting more informed asset allocation decisions.

Traders rely on these platforms for real-time scenario evaluation. For instance, investors can test how interest rate increases or unexpected economic changes might affect their holdings.

This method minimizes uncertainty and assists modern investors in developing more durable strategies in unpredictable financial situations.

Machine learning for credit risk assessment

Stress testing platforms establish a solid foundation for more thorough credit evaluations. Machine learning takes over to assess borrowers’ financial health with accuracy and efficiency.

By reviewing historical data, it detects trends to forecast defaults or late payments. These findings enable investors to evaluate lending risks prior to making decisions.

Algorithms classify borrowers based on risk levels using intricate factors such as income stability, debt-to-income ratios, and payment history. Unlike conventional methods, this approach adjusts to changing market conditions swiftly.

Traders can improve their investment strategy by identifying high-risk profiles early, preventing potential losses while managing portfolios efficiently.

AI tools for fraud detection

AI-powered fraud detection tools serve as essential financial technology in protecting investments. These systems analyze extensive amounts of data to identify suspicious activity across accounts and transactions.

By applying machine learning models, they detect concealed patterns often overlooked by manual processes or traditional risk assessment methods.

Many platforms implement predictive modeling to foresee potential threats before they grow. For example, algorithms can detect unusual trading behaviors or irregular fund transfers within moments.

This ability helps traders safeguard portfolios while reinforcing their overall investment approach against market fluctuations and security risks.

Strategies for Implementing AI in Risk Management

Implementing AI in risk management takes careful planning and precision. Start small, then build on successes to refine your investment strategies over time.

Building effective AI Risk Management Frameworks

Start by evaluating your investment goals and risk tolerance. Align these elements with AI-supported tools to create a framework suited to specific needs. Apply predictive modeling for analyzing market trends, identifying vulnerabilities, and avoiding costly mistakes.

Strong data analytics are the foundation of any successful system because accurate insights lead to better decisions.

Incorporate compliance management steps into the structure early on. Regulators often monitor how traders apply technology in financial forecasting and asset allocation. Include automated safeguards to identify inconsistencies or risks promptly.

Regularly update systems as markets change to maintain reliability in portfolio management strategies.

Ensuring compliance with regulatory standards

Regulations demand strict adherence to protect investors and markets. AI risk management systems simplify this complex task by monitoring changes in compliance frameworks. These tools quickly identify potential violations using data analytics and predictive modeling.

Machine learning algorithms flag irregularities in real-time, reducing penalties or fines for non-compliance. Automated checks ensure portfolios align with financial regulations while minimizing risks.

Let’s examine how these systems aid investment strategies with effective tools for fraud detection next.

Conclusion

AI risk management systems are changing how investors handle uncertainty. They analyze data quickly, predict risks early, and support smarter decisions. These tools assist traders in maintaining an edge in fast-moving markets.

For both beginners and experts, they provide clarity to complex investments. Investing wisely is no longer a guessing game with AI assisting you.